Facing Foreclosure Can Feel Like an Overwhelming and Isolating Experience

The threat of losing your home to a bank or public auction is daunting, but it’s crucial to understand that you have options. Many homeowners believe their only choice is to wait for the inevitable, but strategically selling your house before or during the foreclosure process can be a powerful way to mitigate losses, protect your credit, and regain control of your financial future.

Understanding the Foreclosure Process:

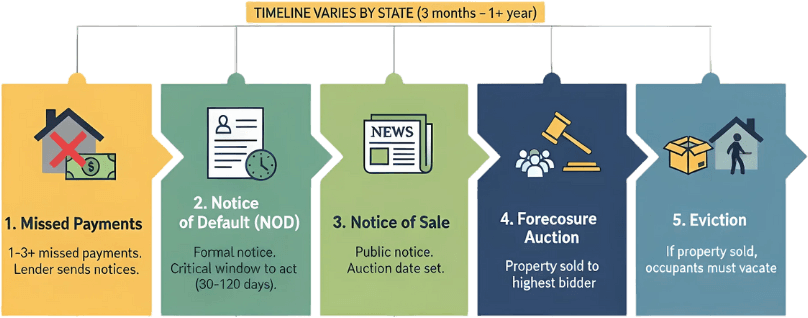

The foreclosure process is the legal procedure by which a lender repossesses a property when the borrower fails to make mortgage payments. While specific foreclosure laws vary by state, the general stages are similar.

How long does the foreclosure process take?

This varies significantly by state and the type of foreclosure (judicial vs. non-judicial). It can range from a few months in some states to over a year in others. The key takeaway is that you usually have a window of opportunity to take action, especially after receiving a Notice of Default.

How to Stop Foreclosure: Your Primary Options

The goal is to intervene before the foreclosure auction. Here are the most common strategies:

#1 – Selling Your Home Traditionally (with a Real Estate Agent)

If you have sufficient equity in your home and enough time before the foreclosure auction, a traditional sale might be an option.

- Pros: You could potentially recoup your equity and even profit.

- Cons: This option requires time (typically 30-60+ days to close), the home needs to be market-ready, and you’ll incur agent commissions and closing costs. This is often only viable in the very early stages of the foreclosure process.

#2 – The Short Sale

A short sale occurs when you sell your home for less than the outstanding mortgage balance, and the lender agrees to accept the reduced payoff. This is a complex negotiation with your lender but can be an effective way to avoid foreclosure if you’re underwater on your mortgage.

- Pros: Avoids foreclosure on your credit report (often listed as “paid in full for less than agreed”), and the lender may waive the deficiency (the remaining balance owed).

- Cons: Requires lender approval, can be a lengthy process, and still impacts your credit score, though less severely than a foreclosure.

#3 – Selling to a Cash Home Buyer

For homeowners under extreme time pressure, selling to a cash home buyer (often referred to as “we buy houses” companies) can be the fastest and most straightforward solution. These buyers purchase properties directly, often in “as-is” condition.

- Pros:

- Speed: Closes much faster than traditional sales, sometimes in as little as 7-14 days, which is critical when trying to how to stop foreclosure before an auction.

- Convenience: No repairs, renovations, or staging required.

- No Fees: You typically pay no agent commissions or hidden fees.

- Certainty: Cash offers mean no financing contingencies falling through.

- Cons: The offer will likely be below market value, reflecting the speed, convenience, and condition of the home.

This option is particularly appealing for those asking, “How can I sell a house in foreclosure quickly?”

#4 – Deed in Lieu of Foreclosure

With a deed in lieu of foreclosure, you voluntarily transfer ownership of your home back to your mortgage lender to satisfy the mortgage debt. The lender must agree to this, and your property usually needs to be free of other liens.

- Pros: Avoids the public record of a foreclosure, may be less damaging to your credit than a full foreclosure, and can prevent a deficiency judgment.

- Cons: You lose your home, and it still negatively impacts your credit.

#5 – Loan Modification or Forbearance

These involve working directly with your lender to alter your loan terms (modification) or temporarily pause/reduce payments (forbearance).

- Pros: You get to keep your home and potentially make it affordable again.

- Cons: Not always approved, requires consistent payments after the modification/forbearance period, and doesn’t always prevent the eventual foreclosure process if financial hardship persists.

Understanding the Redemption Period: A Last Chance

Some states offer a redemption period after a foreclosure auction. This is a specific timeframe (which can range from a few days to over a year, depending on state foreclosure laws) during which the homeowner can “redeem” their property by paying the full amount owed, including auction costs and interest.

A common question is, “Can I sell my house during redemption period?” In many states that have a redemption period, yes, you can. Selling during this period, especially to a cash buyer, can still allow you to recoup some equity or at least prevent a full loss if you can find a buyer quickly enough to pay off the debt. This requires immediate action and often a buyer who understands the specifics of such transactions.

Time is Running Out:

Get a Last-Chance Solution

The Redemption Period is not a guarantee—it’s the final timer ticking down to the complete loss of your home and any remaining equity. When your options have narrowed, a streamlined sale is often the only realistic path forward.

Don’t risk waiting until the last day of the redemption window.

If you are currently in or approaching your state’s redemption period, you need a solution that is fast, guaranteed, and free of the typical sale bureaucracy.

- Need to close in a week? We can do that.

- Property needs extensive repairs? We buy as-is.

- Need certainty to meet the redemption deadline? Our cash offers are firm.

Take immediate control of your situation. Contact Us right now. We specialize in time-sensitive transactions, helping homeowners sell quickly, even when facing the final foreclosure deadline.

Click Here to Get Your Free, No-Obligation Cash Offer in 24 Hours.

“Gagan and his team at JiT Home Buyers are phenomenal clients. As a realtor in Oakland, california, we have double digit projects together. Gagan is extremely timely and responsive, has industry knowledge, and treats our entire team with respect. We are grateful to partner with JiT Home Buyers and look forward to working with them for years to come.”

– Alex Boles

Crucial Steps When Facing Foreclosure

1. Act Immediately: The moment you receive a Notice of Default, understand that time is your most valuable asset. The longer you wait, the fewer options you’ll have to how to stop foreclosure.

2. Communicate with Your Lender: Open a dialogue. They may have programs or options you weren’t aware of. Document all conversations.

3. Understand Your State’s Foreclosure Laws: Research whether your state has a judicial or non-judicial foreclosure process and if a redemption period applies.

4. Seek Professional Advice:

- Housing Counselors: HUD-approved housing counseling agencies offer free or low-cost advice.

- Real Estate Attorneys: Especially if you want to understand complex foreclosure laws or potential deficiency judgments.

- Tax Advisors: To understand the tax implications of a short sale or foreclosure.

5. Explore All Your Selling Options: Whether it’s a traditional sale, short sale, or a fast cash offer, understand which path best suits your timeline and financial situation.

Frequently Asked Questions

About Foreclosure Sales

Do I Receive Clear Title?

The Sheriff cannot guarantee clear title. Buyers should conduct thorough title searches. Find detailed information about Sheriff sales on their website or in the Daily Reporter newspaper (published Tuesdays). Due to high volume, limited information is available. For legal questions, consult an attorney.

What Are the Steps for Foreclosure Action?

A foreclosure proceeding leading to Sheriff’s sale follows this sequence:

- Complaint initiates court process

- Foreclosure judgment issued (3-9 months later)

- Order directs Sheriff’s Office to auction property

- Property advertised for 3 weeks before auction

- Auction conducted, property sold to highest bidder

- Confirmation order issued within 30-60 days

- Buyer pays balance and records deed

What About Vacant Properties in Foreclosure?

To check status, obtain the owner’s name from the County Auditor’s website. Search court records by name or case number. Properties won’t proceed to sale until the Praecipe is filed.

When Must I Vacate for Sheriff’s Sale?

You can redeem your property until confirmation filing (typically 30-60 days post-sale). Once confirmed, you lose redemption rights and the buyer can obtain a writ of possession. The Sheriff will notify you of vacation requirements.

Tenant Rights During Foreclosure

If you’re leasing a foreclosed property, the buyer may allow you to remain or have the Sheriff issue vacation notice. Consult an attorney about your specific rights as a tenant.

When must I vacate my foreclosed home?

You can remain in the property until the court confirmation is filed, typically 30-60 days after the sale.

Can I put down more than the required deposit?

Yes, you can deposit more than the minimum if it doesn’t exceed the purchase price.

Who should the deposit check be made out to?

The Sheriff recommends the check be made payable to yourself. If not the winning bidder, you can redeposit the funds.

What if a property is not re-advertised?

It was likely withdrawn from sale or a bankruptcy was filed, halting the process. Check court records to verify.

Can I start renovations right after buying a vacant property?

Wait until after the confirmation files and awards possession. Until then, you risk the defendant redeeming.

Take Control of Your Situation Today

Facing foreclosure is undoubtedly stressful, but it’s not a death sentence for your finances. By understanding the foreclosure process, knowing your options for how to sell a house in foreclosure, and acting decisively, you can navigate this challenging period effectively. Whether you aim to stop foreclosure entirely, minimize credit damage, or protect any remaining equity, informed action is your best defense.

Don’t let the foreclosure auction be the end of your story. If you’re looking for a swift, straightforward way to sell a house in foreclosure and avoid further complications, a cash offer can be your strongest option.

Ready to explore a guaranteed, no-obligation solution?

At JiT Home Buyers, we specialize in helping homeowners like you navigate difficult situations, including impending foreclosure. We can provide a fair cash offer for your house quickly, often closing in a matter of days or weeks, allowing you to walk away with cash and put the foreclosure behind you. There are no repairs needed, no commissions to pay, and no lengthy waiting periods.

Contact today for a free, confidential consultation and get a fast cash offer to take control of your financial future.